If you’ve been living in the depths of outer space, or deep beneath the ocean waves – basically, wherever you can’t get a decent Wi-Fi signal – then you may not know that housing prices are plummeting. I’m not here to sound the alarm, just because home prices are falling faster than a NASA satellite.

But the recent data is pretty startling.

The Case-Shiller index – widely accepted as the most accurate indicator of average home prices - recently released some shocking numbers for the last 3 months of 2008.

What does the detailed data show? Well, the housing market is pretty shitty, pretty much everywhere. Numbers range from down 7% for Boston, to down 33% for Las Vegas. Detroit’s even worse, but I think housing prices there have been dropping 33% per month since 1982.

You can probably buy a 5-bedroom, 6.5 bath mansion in Detroit for about $12,000 right now. That includes home theater, handball court, wet bar, dry bar, AND raw bar. The former owners were no doubt foreclosed on after they got laid off from the Ford factory, and are living under a bridge somewhere - eating Acorn and Dirt Stew, with newspaper for shoes, and no way to get out of the lease on their Maserati.

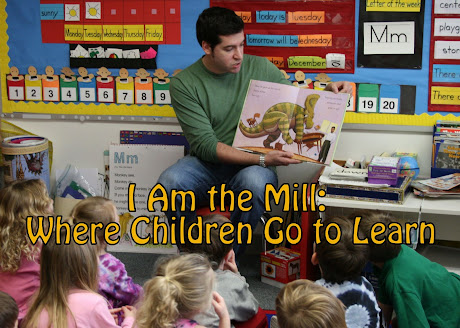

So you’re probably thinking, “Mill, how do I take advantage of all this misfortune and misery?”

First of all, you’re a sick bastard for thinking that. Secondly, that’s a great question.

And the logical follow-up question: When is the right time to jump in and snag some super-sweet deals on real estate?

It’s a difficult thing to predict. More difficult than splitting the atom, or putting a man on the moon. Tougher than hitting a Roger Clemens fastball, and rougher than replicating a Mario Batali ravioli.

If you wait too long, then you’ll miss out on the deal of a lifetime. But if you jump in too soon, you’ll feel like an asshole. You need to time it just right.

My advice? If you see a house you like, and it’s been on the market for more than 3 months, put in a bid that’s 25% of the asking price. That way, if your bid is accepted, you have a nice, fat downside cushion to protect you as the market eventually finds a rocky bottom somewhere. If you REALLY love the house, offer 35% of the price.

Bid super-low and super-often, and you might just get lucky.

Anything less conservative, and I’m afraid you’ll lose money. And then you’ll blame me. And that would make me feel bad. Because all I want is to be loved.

Alternatively, you could just wait and see. This economic catastrophe thing ain’t anywhere near over. There are still 4 million vacant homes in Florida, waiting to be snatched up at bargain basement prices - so that the next generation of speculators can start this thing all over again.

According to my own analysis, before things turn around, the number of will be close to 50 million vacant Florida homes, and 500 million foreclosed homes overall. 25 billion people will be out of work in this country, and 600 billion more will be working part-time at Wal-Mart in order to put food on the table.

So you can see, it's going to get somewhat worse before it gets slightly better.

Mark my words.

Wednesday, February 25, 2009

Houses, Houses Everywhere

Posted by

The Mill

at

10:54 PM

![]()

Labels: economic collapse, real estate prices

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment